Filling out the Illinois Withholding Allowance Worksheet is an important step in ensuring that the correct amount of taxes is withheld from your paycheck. This worksheet helps determine how many allowances you can claim, which in turn affects the amount of money that is withheld for state taxes.

It is crucial to fill out this form accurately to avoid underpaying or overpaying your taxes. By taking the time to complete the Illinois Withholding Allowance Worksheet correctly, you can ensure that you are not hit with any surprises come tax time.

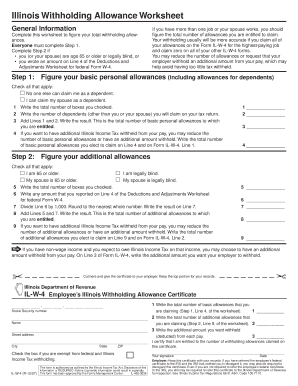

How to Fill Out the Illinois Withholding Allowance Worksheet

1. Start by entering your personal information at the top of the worksheet, including your name, Social Security number, and filing status.

2. Next, carefully read through each line of the worksheet and follow the instructions provided. You will be asked to make adjustments based on your specific situation, such as whether you have dependents or if you are claiming any deductions.

3. Be sure to double-check your calculations and make sure that all the information you provide is accurate. Any errors could result in an incorrect amount of taxes being withheld from your paycheck.

4. Once you have completed the worksheet, make sure to sign and date it before submitting it to your employer. They will use this information to determine how much to withhold from your pay for state taxes.

5. It is recommended to review your withholding allowances periodically, especially if there are any changes in your financial situation, such as getting married, having a child, or buying a home. This will help ensure that you are still withholding the correct amount of taxes.

By following these steps and filling out the Illinois Withholding Allowance Worksheet accurately, you can take control of your tax withholdings and avoid any surprises when it comes time to file your taxes.

In conclusion, the Illinois Withholding Allowance Worksheet is a valuable tool that can help you manage your tax withholdings effectively. By taking the time to fill it out correctly and making any necessary adjustments, you can ensure that you are not overpaying or underpaying your state taxes.