In the world of investing, it’s important to understand the tax implications of your earnings. One key aspect to consider is whether your dividends are considered qualified or ordinary. Qualified dividends are taxed at a lower rate than ordinary dividends, making them a more favorable option for investors. Additionally, understanding the capital gain tax worksheet for 2024 can help you accurately calculate and report your capital gains to the IRS.

Qualified dividends are dividends that meet specific criteria set by the IRS. These dividends are typically paid by U.S. corporations or qualified foreign corporations. To be considered qualified, the dividends must be held for a certain period of time and meet other requirements. The tax rate for qualified dividends is lower than the tax rate for ordinary dividends, making them a more attractive option for investors.

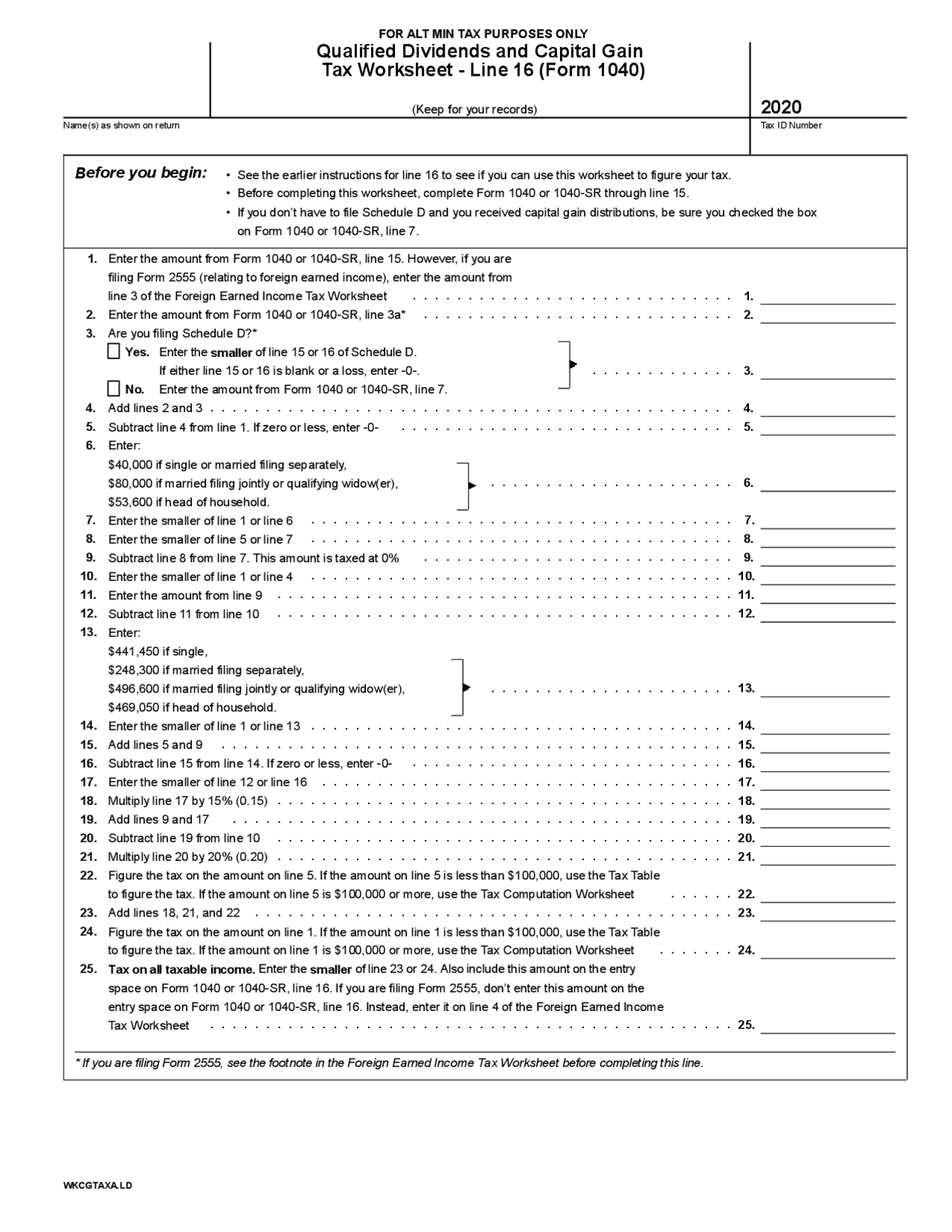

When it comes to reporting your capital gains for the tax year 2024, you will need to use the Capital Gain Tax Worksheet. This worksheet helps you calculate the tax on your capital gains based on your filing status and total income. By accurately completing this worksheet, you can ensure that you are paying the correct amount of tax on your capital gains.

It’s important to note that the tax rates for qualified dividends and capital gains can vary depending on your income level. For the tax year 2024, the tax rates for qualified dividends range from 0% to 20%, while the tax rates for long-term capital gains range from 0% to 20% as well. Understanding these rates and how they apply to your specific situation can help you minimize your tax liability.

In conclusion, understanding qualified dividends and the capital gain tax worksheet for 2024 is essential for investors looking to maximize their returns while minimizing their tax liability. By taking the time to educate yourself on these topics and accurately reporting your earnings to the IRS, you can ensure that you are in compliance with tax laws and making the most of your investments.