IRS Tax Computation Worksheet 2023

The IRS Tax Computation Worksheet for 2023 is an essential tool for calculating your federal income tax liability. This worksheet helps taxpayers determine the amount of tax they owe based on their income, deductions, and credits. It is important to accurately complete this worksheet to avoid any potential errors in your tax return.

The IRS updates the tax computation worksheet each year to reflect changes in tax laws and rates. For the 2023 tax year, taxpayers will need to refer to the updated worksheet to ensure they are calculating their tax liability correctly. This worksheet can be found on the IRS website or in the instructions for Form 1040.

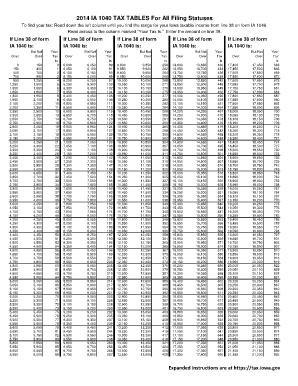

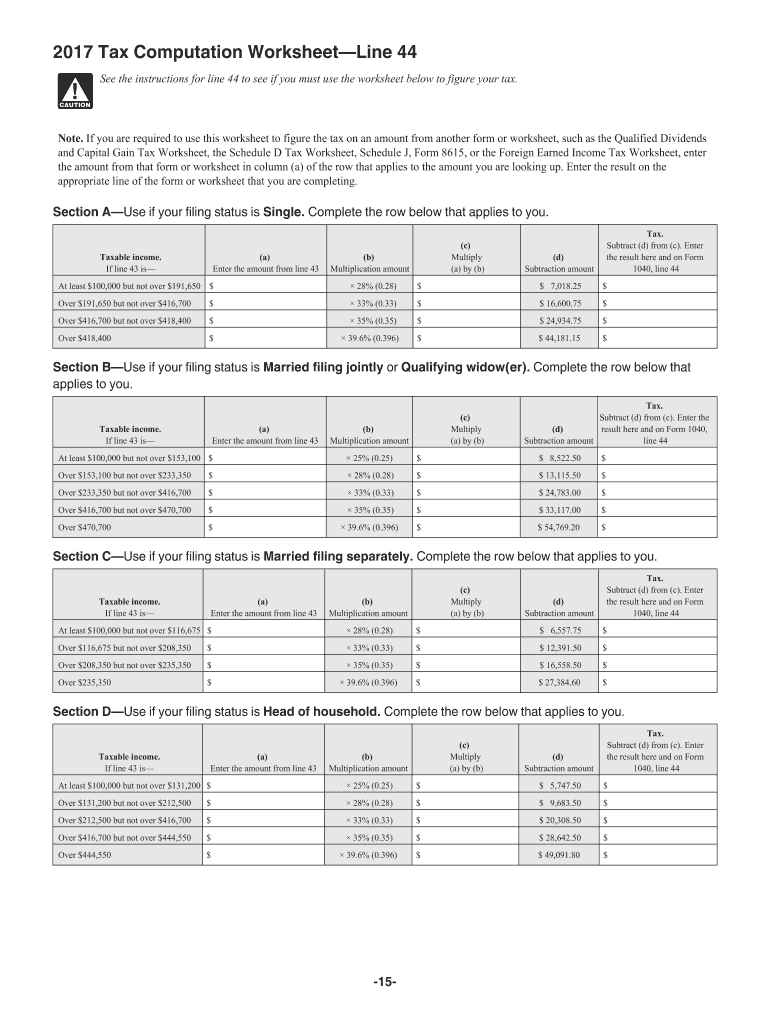

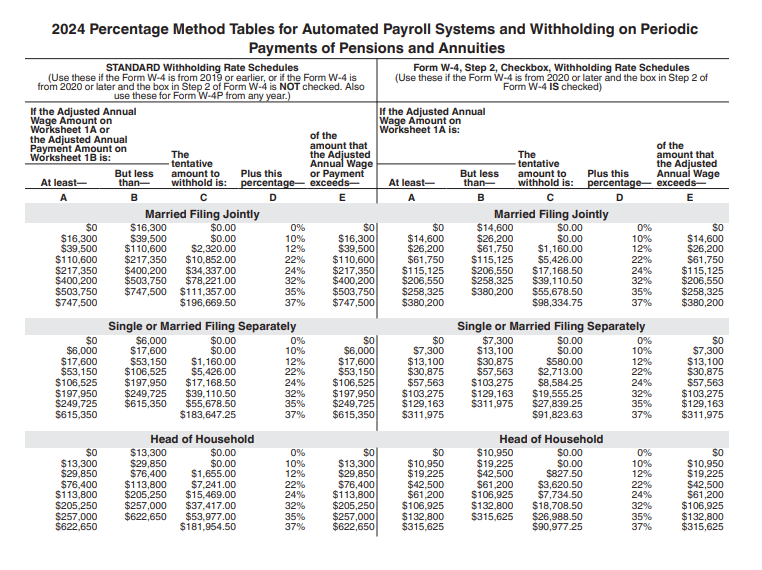

The IRS Tax Computation Worksheet for 2023 consists of several sections that help taxpayers calculate their tax liability step by step. These sections include determining adjusted gross income, applying standard or itemized deductions, calculating taxable income, and applying tax credits. By following the instructions on the worksheet, taxpayers can arrive at the correct amount of federal income tax they owe for the year.

One key aspect of the IRS Tax Computation Worksheet is the calculation of tax credits, which can help reduce a taxpayer’s overall tax liability. Tax credits are subtracted directly from the amount of tax owed, providing a dollar-for-dollar reduction in taxes. By accurately calculating tax credits on the worksheet, taxpayers can maximize their tax savings.

It is important for taxpayers to carefully review their completed tax computation worksheet to ensure all information is accurate and all calculations are correct. Mistakes on the worksheet can result in errors on your tax return and potentially lead to penalties or audits. By taking the time to accurately complete the worksheet, taxpayers can avoid these issues and ensure they are paying the correct amount of tax.

In conclusion, the IRS Tax Computation Worksheet for 2023 is a valuable tool for calculating your federal income tax liability. By following the instructions on the worksheet and carefully inputting your financial information, you can accurately determine the amount of tax you owe for the year. Be sure to review your completed worksheet thoroughly before submitting your tax return to avoid any potential errors.