Itemized deductions are expenses that taxpayers can claim on their federal income tax returns to reduce their taxable income. These deductions can help taxpayers reduce the amount of taxes they owe to the government. One way to keep track of and calculate your itemized deductions is by using an Itemized Deductions Worksheet.

An Itemized Deductions Worksheet is a tool that helps taxpayers organize and calculate their deductible expenses, such as medical expenses, mortgage interest, charitable contributions, and state and local taxes. By using this worksheet, taxpayers can ensure they are claiming all the deductions they are eligible for and maximize their tax savings.

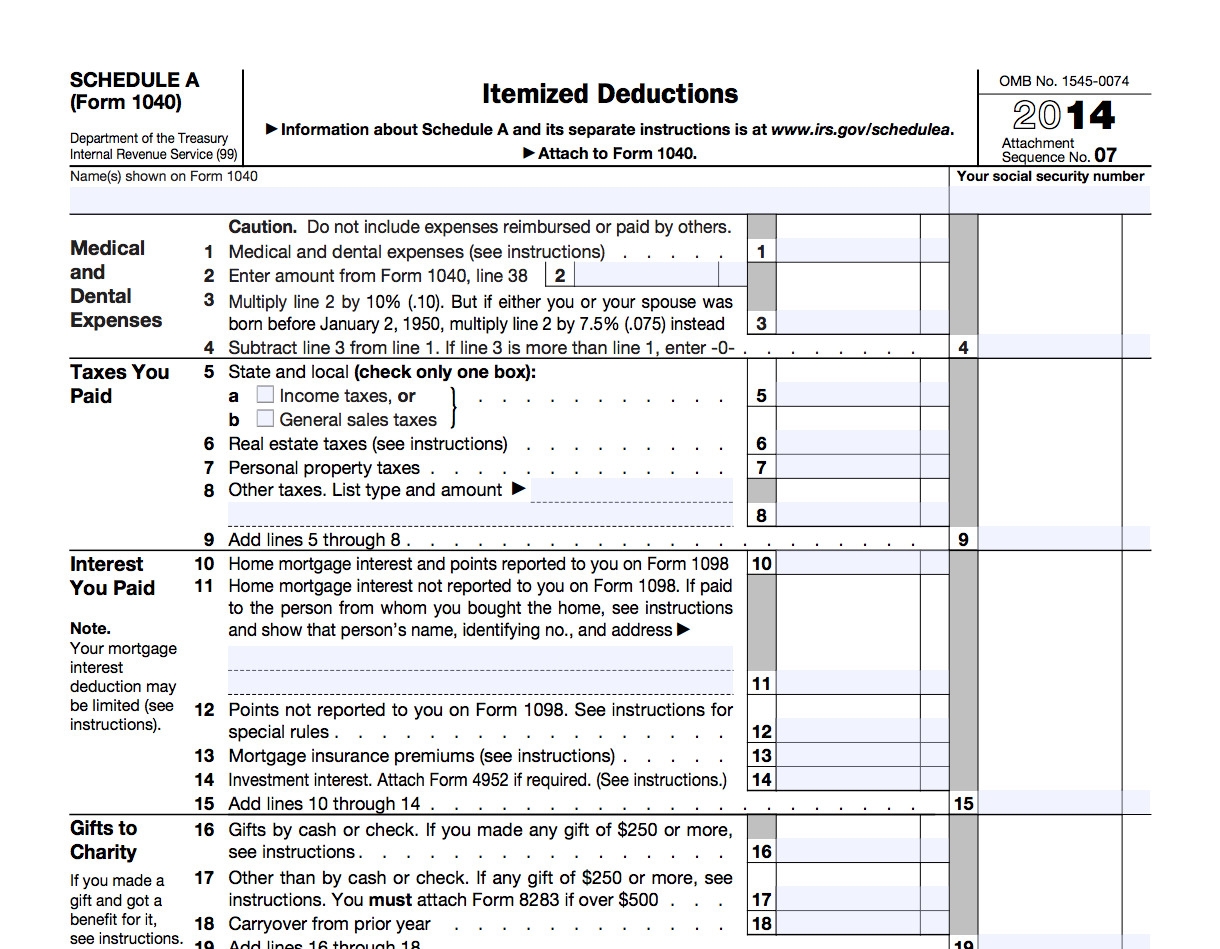

Itemized Deductions Worksheet

The Itemized Deductions Worksheet typically includes categories for various deductible expenses, such as medical and dental expenses, state and local taxes, mortgage interest, charitable contributions, and miscellaneous deductions. Taxpayers can input their expenses for each category and calculate the total amount of itemized deductions they can claim on their tax return.

It is important for taxpayers to keep accurate records of their expenses and receipts to support their itemized deductions. The IRS may request documentation to verify the deductions claimed on a tax return, so it is crucial to have all necessary documentation in case of an audit.

Using an Itemized Deductions Worksheet can also help taxpayers determine whether it is more beneficial to take the standard deduction or itemize their deductions. The standard deduction is a flat amount that taxpayers can deduct from their taxable income without having to itemize their expenses. Taxpayers should compare their total itemized deductions to the standard deduction amount to see which option results in a lower tax liability.

In conclusion, an Itemized Deductions Worksheet is a valuable tool for taxpayers to organize and calculate their deductible expenses, maximize their tax savings, and ensure they are claiming all eligible deductions on their tax return. By keeping accurate records and utilizing this worksheet, taxpayers can effectively manage their finances and reduce their tax burden.

Overall, understanding and utilizing an Itemized Deductions Worksheet can help taxpayers navigate the complex world of tax deductions and ultimately save money on their taxes.