Qualified dividends are a type of investment income that is taxed at a lower rate than ordinary income. This tax break is designed to encourage long-term investment and provide an incentive for individuals to invest in the stock market. The tax rate on qualified dividends is typically lower than the tax rate on ordinary income, making them an attractive option for investors looking to minimize their tax liability.

Capital gains are another form of investment income that can be taxed at a lower rate. When you sell an asset, such as a stock or a piece of real estate, for more than you paid for it, you realize a capital gain. The tax rate on capital gains depends on how long you held the asset before selling it, with long-term capital gains being taxed at a lower rate than short-term capital gains.

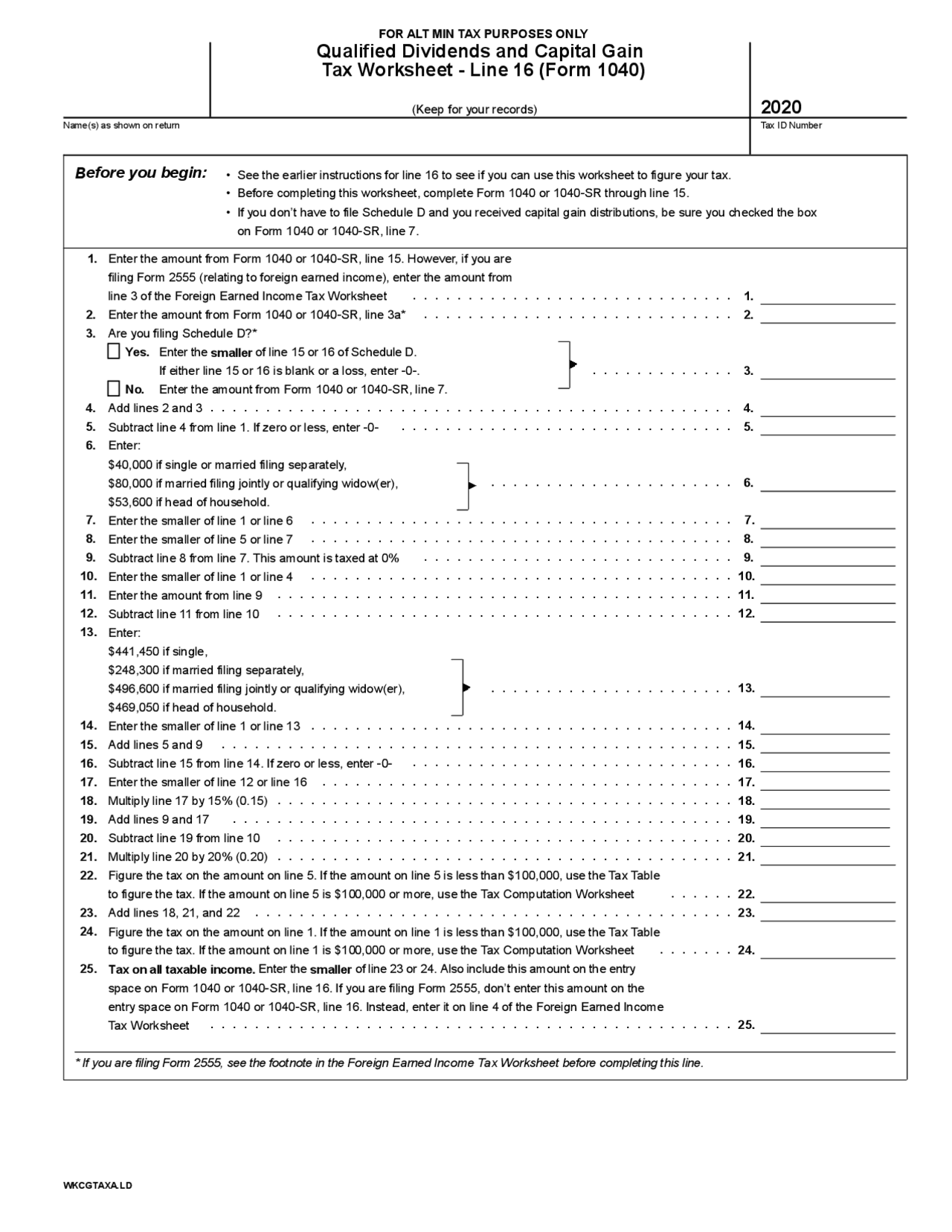

Qualified Dividends Capital Gain Tax Worksheet

When it comes to calculating the tax on qualified dividends and capital gains, the IRS provides a worksheet that helps individuals determine the amount of tax they owe. The worksheet takes into account a variety of factors, including the individual’s filing status, total income, and the amount of qualified dividends and capital gains they received during the tax year.

The worksheet guides individuals through a series of steps to calculate their tax liability on qualified dividends and capital gains. It helps to determine the portion of these investment incomes that are subject to the lower tax rates and calculates the tax owed based on the individual’s total income for the year.

By using the qualified dividends capital gain tax worksheet, individuals can ensure that they are taking advantage of the lower tax rates on investment income and minimize their tax liability. It provides a clear and structured way to calculate the tax owed on qualified dividends and capital gains, making the process easier for taxpayers.

It is important for individuals who receive qualified dividends and capital gains to understand how these types of income are taxed and to take advantage of any available tax breaks. By using the qualified dividends capital gain tax worksheet, taxpayers can ensure that they are accurately calculating their tax liability and maximizing their after-tax returns on their investments.

In conclusion, the qualified dividends capital gain tax worksheet is a valuable tool for individuals who receive investment income. By following the steps outlined in the worksheet, taxpayers can determine the amount of tax they owe on their qualified dividends and capital gains and take advantage of the lower tax rates available for these types of income. Understanding how investment income is taxed and using the worksheet to calculate tax liability can help individuals minimize their tax burden and maximize their investment returns.