As an employee, understanding your pay stub worksheet can help you keep track of your earnings, deductions, and taxes. It provides a detailed breakdown of your pay and allows you to ensure that you are being paid correctly. By familiarizing yourself with the information on your pay stub, you can better manage your finances and address any discrepancies that may arise.

Reading a pay stub worksheet may seem overwhelming at first, but with a little guidance, you can easily decipher the information it contains. This document is essential for keeping track of your earnings, deductions, and taxes, so it is important to understand how to read and interpret it correctly.

Reading a Pay Stub Worksheet

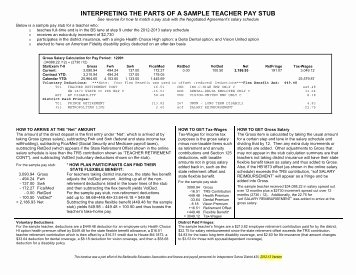

When looking at your pay stub worksheet, the first thing you will see is your gross pay. This is the total amount of money you have earned before any deductions are taken out. It includes your hourly rate or salary and the number of hours you worked during the pay period. Next, you will see your net pay, which is the amount of money you take home after all deductions have been subtracted.

After your gross and net pay, you will see a breakdown of any deductions that have been taken out of your paycheck. These may include federal and state taxes, Social Security and Medicare contributions, health insurance premiums, retirement contributions, and any other deductions you have authorized. It is important to review these deductions carefully to ensure that they are accurate.

In addition to deductions, your pay stub worksheet may also include information about any additional income you have earned during the pay period, such as overtime pay or bonuses. This information can help you track your earnings and plan for future expenses.

Finally, your pay stub may also include year-to-date totals for your earnings, deductions, and taxes. This information can be helpful for budgeting and tax planning purposes, as it provides a summary of your financial activity over the course of the year.

By taking the time to review and understand your pay stub worksheet, you can ensure that you are being paid correctly and make informed decisions about your finances. If you have any questions or notice any discrepancies on your pay stub, be sure to reach out to your employer or human resources department for clarification.

In conclusion, reading a pay stub worksheet is an important skill for all employees. By understanding the information it contains, you can better manage your finances and ensure that you are being paid accurately. Take the time to review your pay stub regularly and address any issues that may arise to stay on top of your earnings and deductions.