Investing in rental properties can be a lucrative venture, but it’s important to keep track of your expenses and understand the cost basis of your property. A cost basis worksheet is a tool that helps you calculate the total cost of acquiring and improving your rental property. This information is crucial when it comes time to sell the property, as it will determine your capital gains tax liability.

By maintaining a detailed cost basis worksheet, you can ensure that you are maximizing your tax benefits and accurately reporting your income and expenses to the IRS. This document will contain information on the purchase price of the property, any closing costs, renovation expenses, and other costs associated with acquiring and maintaining the property.

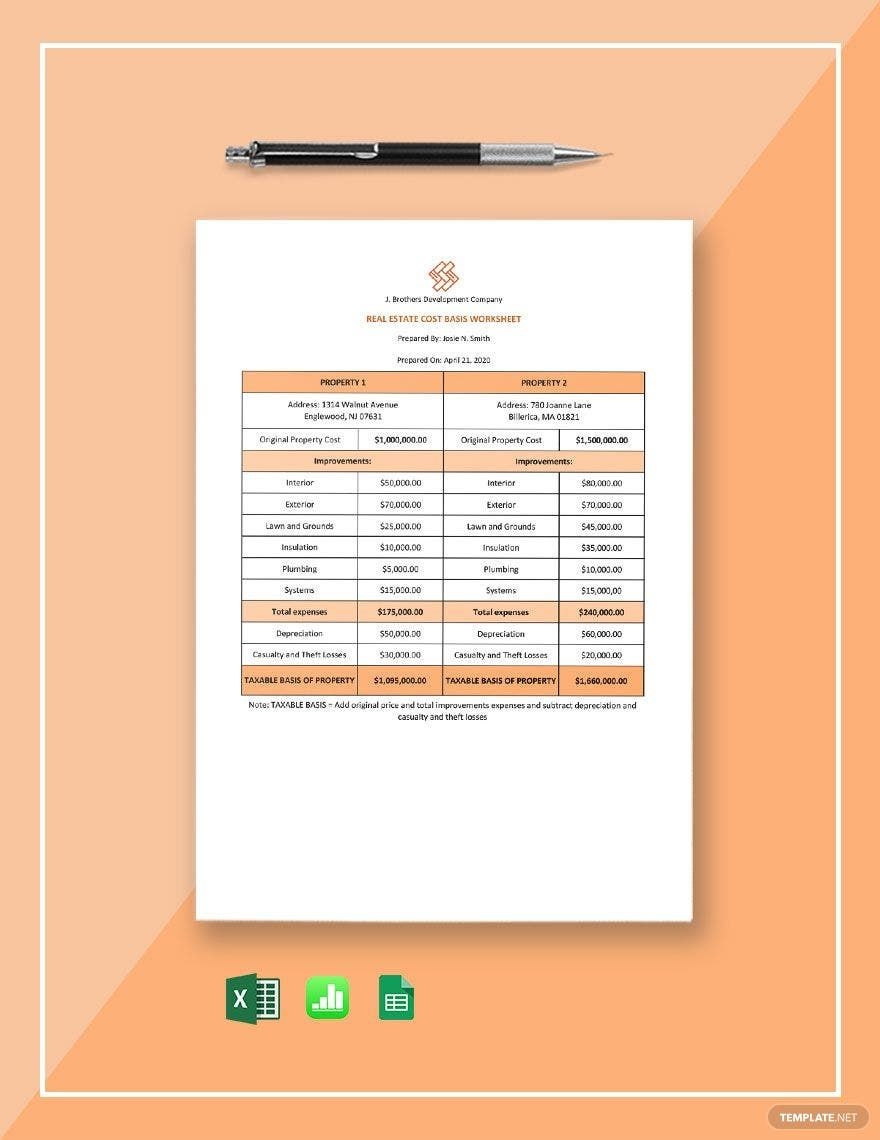

Rental Property Cost Basis Worksheet

When filling out a cost basis worksheet for your rental property, be sure to include all relevant expenses incurred during the acquisition and ownership of the property. This may include:

- Purchase price of the property

- Closing costs, such as title insurance and attorney fees

- Cost of improvements and renovations

- Cost of repairs and maintenance

- Property management fees

It’s important to keep detailed records of all expenses related to your rental property, as these costs will be used to calculate your cost basis and potential capital gains when you sell the property. This information will also be helpful in determining your depreciation deduction each year.

By accurately tracking your rental property cost basis, you can potentially reduce your taxable income and maximize your tax benefits. It’s important to consult with a tax professional or accountant to ensure that you are properly reporting your expenses and taking advantage of all available deductions.

In conclusion, maintaining a rental property cost basis worksheet is essential for every property owner. By keeping accurate records of your expenses and understanding the cost basis of your property, you can minimize your tax liability and maximize your profits. Be sure to consult with a professional to ensure that you are properly reporting your income and expenses to the IRS.