Many individuals rely on Social Security benefits as a source of income during retirement. However, it’s important to understand that these benefits may be subject to taxation, depending on your total income. The Social Security Benefits Taxable Worksheet is a tool provided by the IRS to help individuals determine if their benefits are taxable.

When it comes to calculating the taxability of Social Security benefits, it’s not a straightforward process. The amount of your benefits that are subject to taxation depends on your filing status and total income. The Social Security Benefits Taxable Worksheet helps individuals determine the taxable portion of their benefits based on their specific financial situation.

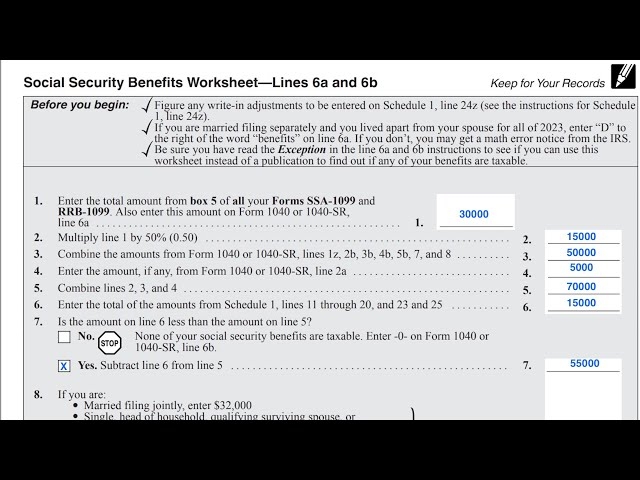

Using the worksheet, individuals can input their total income, including half of their Social Security benefits, and compare it to a base amount set by the IRS. If your income is below the base amount, your benefits will not be taxable. However, if your income exceeds the base amount, up to 85% of your benefits may be subject to taxation.

It’s essential for individuals approaching retirement age to familiarize themselves with the Social Security Benefits Taxable Worksheet and understand how it may impact their tax liability. By accurately calculating the taxability of your benefits, you can avoid any surprises come tax time and properly plan for any additional tax obligations.

Additionally, the worksheet can help individuals identify any potential tax-saving strategies, such as adjusting their income sources or contributions to tax-advantaged accounts. By proactively using the Social Security Benefits Taxable Worksheet, individuals can optimize their tax situation and make informed decisions regarding their retirement income.

In conclusion, the Social Security Benefits Taxable Worksheet is a valuable tool for individuals receiving Social Security benefits to determine if their benefits are subject to taxation. By understanding how the worksheet works and accurately calculating the taxability of your benefits, you can effectively plan for any additional tax obligations and optimize your retirement income strategy.